How Does the Solar Tax Credit Work?

Millions of Americans are weighing the cost-benefit of adding solar panels to their home to save money on utility bills, have a back-up power source when the grid goes down, and live more sustainably by powering their life with the sun. As solar educators, we’ve helped thousands of people make the switch to solar power. If you live in the U.S. and are considering taking the solar plunge, you can save a bundle through both federal and state tax credit programs! If you’re looking for inspiration, check out our recent blogs to learn about families across the U.S. who have made the switch to solar on their homes and RVs.

With programs intended to help save you money and alleviate the initial upfront installation cost (whether you do it yourself or hire a professional), anyone with a traditional home, or one that rolls, or floats can afford to get into the solar game and start taking control over their own power.

Table of contents:

Am I Eligible for the Federal Solar Tax Credit?

You can apply the credit if you meet the following 3 criteria:

1.Your solar powered system was installed between January 1, 2017, and December 31, 2034.

2.The solar system is located at your residence in the United States.

AND You own the solar powered system (i.e., you purchased it with cash or through financing. Neither leasing the equipment nor paying a solar company for the energy produced by the system on your house qualifies for the tax credit.) OR You invested in an interest in an off-site community solar project. See this link for more information.

3.The solar powered system is new or being used for the first time. The credit can only be applied to the “original installation,” (i.e., if you bought a home with a solar powered system already installed, you cannot take the credit.)

How Does the Federal Solar Tax Credit Work?

As defined by the IRS, a home includes a “house, houseboat, mobile home, apartment cooperative, condominium, or manufactured home.” So, yes, the solar powered system you put on your RV/van, off-grid cabin, or boat qualifies for the program, whether you hired a professional installer or did it yourself! The federal solar tax credit not only applies to your primary residence, but also to a vacation or secondary home. If you rent out your second home as a business, you can only apply for the commercial investment incentive program. There are some special circumstances that apply if you rent it out for part of the year while also using it for personal use – see this article to be certain that this tax credit will work for you.

What Type of System Qualifies & How Much Can I Claim?

The federal solar tax credit applies to any complete solar system (of any size) installed and operational between January, 1, 2017 and December 31, 2034 will qualify. Both on-grid or off-grid systems are included in the program, as well as any shared systems of which you might be a partial owner, referred to as Community Solar. If the system is (or was) installed and operational during the following years, your credit will be:

●2017 - 2019* = 30%

●2020 - 2021* = 26% (per the laws that were in place at that time)

●2022 - 2032 = 30%

●2033 = 26%

●2034 = 22%

●2035 = 0% (tax credit expires)

*If you have already installed your system and didn’t file for the tax credit with that year’s tax return, all you need to do is file an amended claim for the tax year or years that are affected by your installation.

It is important to note that if your federal solar tax credit ends up being more than your total tax owed on this year’s return, you can carry the remainder over on future returns until you’ve met that total credit allowed!

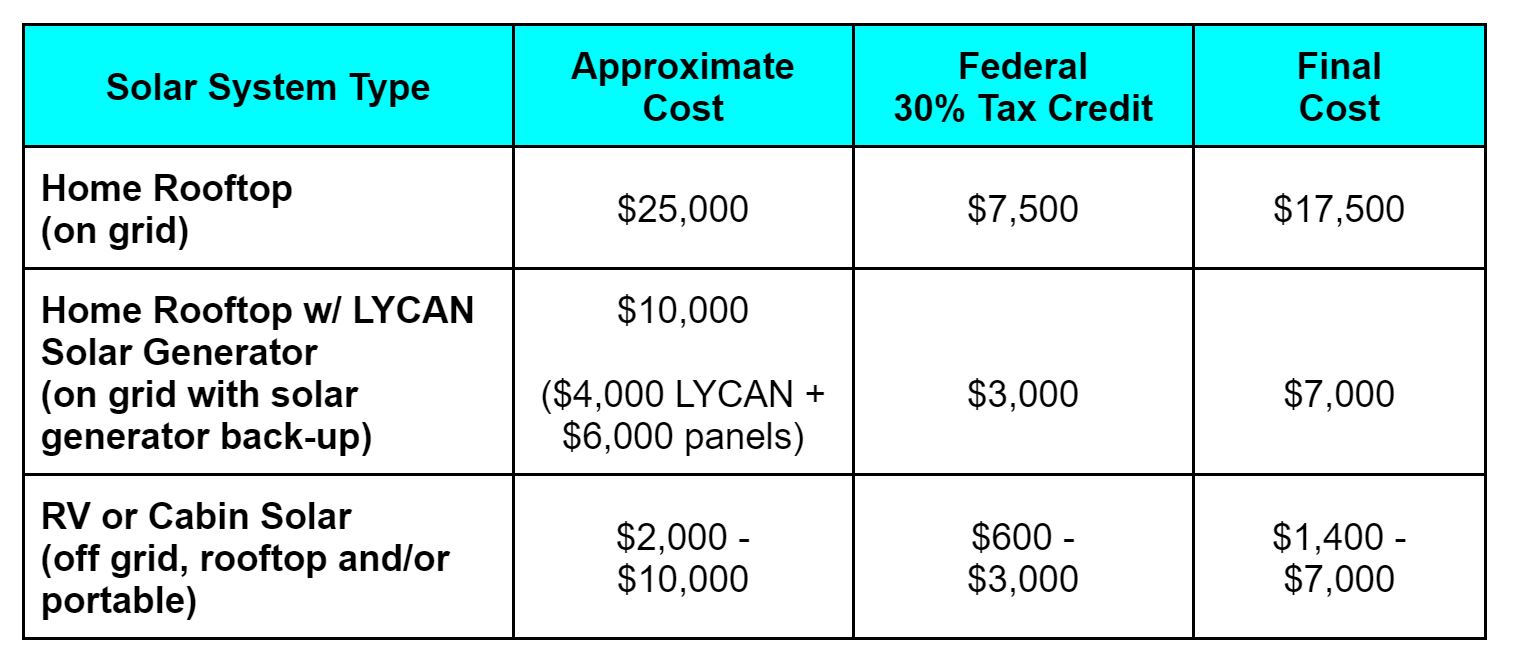

Let’s do some quick math to see how much you can save…

You want to install a complete system for your home, approximately $25,000, depending on the size of your home, energy usage, and location. If you install the system this year, your tax credit will be a whopping $7500, so ultimately the entire system will only cost you $17,500. Depending upon how your utility company reimburses you for the excess power that is generated and sent back to the grid, the time it will take for your system to repay you can be greatly reduced!

Or, maybe you have frequent power outages in your area and need a reliable whole home solar generator like the Renogy LYCAN 5000 Power Box in order to run your major home appliances until the power grid returns to normal? You may spend up to $10,000 on this system (including a maximum of 4800W of solar panels), and can write off $3000 of it with the 30% federal solar tax credit. Look into state programs like California’s Self-Generation Incentive Program which offers rebates on home battery storage!

If you are an RVer, boat owner, or have an off-grid cabin, you may spend anywhere from $2000 to $10,000 on a complete system, depending on your energy needs, where you travel/live, and the size of your rig/cabin. Our friends recently installed a complete Renogy REGO system in their Forest River “Wolf Pup” travel trailer. Their total system, including panels, components, and all additional wiring, etc. cost about $8,500, allowing them to write off $2550 – bringing the total cost of their installation to under $6000 with the federal solar tax credit. This system will allow them to run their lives and business completely off-grid and run numerous household appliances (including their RV air conditioner for a few hours per day). Not a bad investment!

If you are at the beginning stages of planning your off-grid system check out the many solar resources we provide with special attention given to solar newbies, including a downloadable Solar System Sizing Spreadsheet (Excel document).

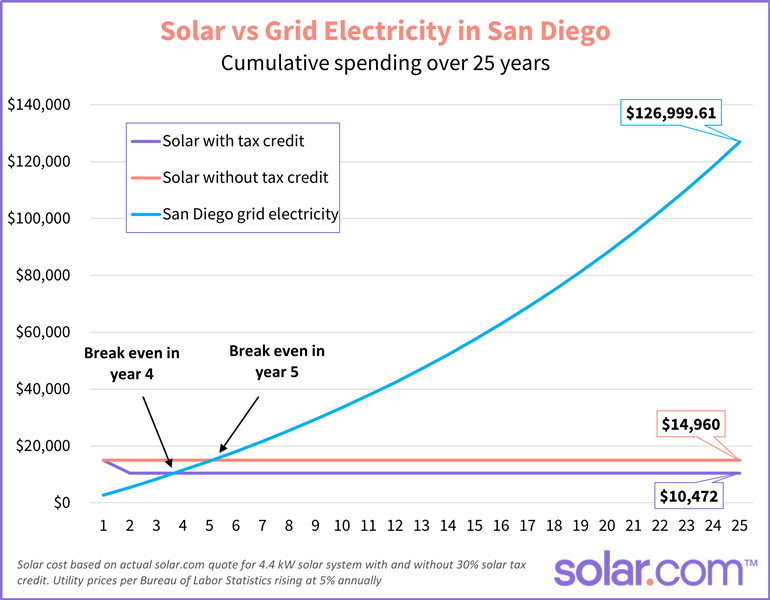

In addition to saving thousands of dollars via tax credits, you can greatly reduce your energy bills over the long term. Many of the families we interviewed were realizing serious savings within the first few years! Let’s look at San Diego, CA as shown in the chart below. A solar investment is estimated to break even at just 4 years after the installation (using just the federal tax credit!), then will offer an additional saving of $112,000 over a 25 year period on electric utility costs!

And, if you own an RV like we do, you can save by using solar rather than staying at campgrounds with electrical hookups. Let’s use our mobile lifestyle as an example. We’ve run on nearly 100% solar power for the past 10.5 years. By boondocking and choosing remote campgrounds with no electrical hook-ups, we typically spend about $1250 per year on camping fees. Over the past 10.5 years, we’ve spent around $13,000. If we had paid for campsites with electrical hook-ups over the same period of time (averaging $40 per night depending on the place/state), we would have spent more than $151,000! Our complete solar powered system cost around $2000. So, $13K (+$2K for our solar powered system) vs. $151K! So, when you combine the solar tax credit with everyday savings, it is truly a no brainer when amortized over the long haul – whether you live in a “sticks and bricks” home or one on wheels!

What Costs Can I Include?

You can include all the costs, such as: materials, products, and labor for installing your solar system. This specifically includes panels that you install directly on the roof, or solar roofing tiles which perform double duty as energy producers and roofing surface. It does not, however, include any improvements that you might need to make to the roof of your house, support reinforcements, etc. which allows your roof to handle the weight of the panels. Even if you have to reinforce your roof, it’s still a roof and cannot be included in the tax credit. Anything specific to the panels, brackets, cables, inverters, and more can be included in the total investment cost.

What IRS Forms Do I File To Report My Expenses?

●Residential Systems: IRS Form 5695

●Commercial Systems: IRS Form 3468

What Records Do I Need to Keep?

Simply retain any receipts for solar equipment and installation fees. You do not need to submit these receipts with your return, but save them with your tax information.

How Do I Find State Solar Incentives?

In addition to the federal solar tax credit extension bill that was passed as part of the 2022 Inflation Reduction Act, many U.S. states also have tax incentives or programs to help you reduce the overall cost of your solar power system, significantly shortening the payback time on your investment.

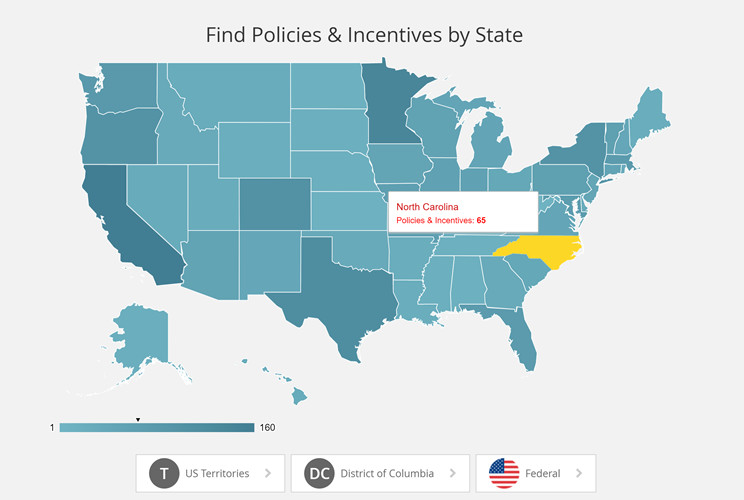

While the federal solar tax credit is pretty straightforward, state incentives are more varied and complex. For example, Massachusetts offers a solar loan reduction plan based upon income, North Carolina allows any solar investment on your home to be excluded from the property tax evaluation, which is also just 1 of the 5 California state solar tax credit incentives available to residents of the Golden State. To learn about your state’s programs and incentives, visit the Database of State Incentives for Renewables & Efficiency. And if you need help navigating the complexity of your state’s programs, finding a local installer might help cut through the confusion.

How Does the California Tax Credit Work?

California currently has 5 different solar incentive programs in place to help Californians go solar. One incentive helps remove the upfront cost of solar through special loans. Others help Californians store solar energy in batteries for the home during times of grid instability or high usage. For some solar users who qualify, the cost of the installation could be reimbursed up to 100% of the total installation – now, that’s gotta be worth looking into!

Taking advantage of a California solar tax credit in 2023 requires that you do some homework, but many installers know all the in and outs. You might want to do it quickly because a recent change to the California Rooftop Solar Rules have significantly reduced the amount that public utilities will pay for the excess energy you produce during peak hours with your rooftop array. While this ruling is currently being appealed, new or current solar projects that have: 1. A signed contract with an installer AND 2. If you or your installer has submitted a complete and correct interconnection application to your utility before April 14, 2023, you can still lock in the previous rates. The installation itself does not need to be completed by this date.

When’s the Best Time to Go Solar?

Solar installations start saving their owners money as soon as they are installed, so the sooner you start the process, the quicker you’ll see your investment start paying you back. While the federal commitment to personal solar and a cleaner energy future is clear for the next 10 years, don’t wait until it’s too late to take advantage of the excellent state and local programs that are helping people make the switch. Solar is here...and it’s designed for all!

In 2012, Shari Galiardi & David Hutchison left behind careers and a comfortable home in North Carolina to travel with the vintage camper trailer they lovingly restored, outfitted with solar, and named "Hamlet." What began as a short break from careers and responsibility quickly turned into a love affair with roadlife. They have parlayed their higher education backgrounds, desire for life-long learning, and thirst for adventure travel into writing, photography, video production, and public speaking gigs from coast to coast. Known to their friends as simply Shari & Hutch, you can learn more about their full-time, solar-powered adventures on their website at freedominacan.com. Or, follow them on Facebook, Instagram, and YouTube as “Freedom in a Can, LLC.”

Related articles:

How Does A Solar Battery Bank Work? | Pros And Cons

Is A Hybrid Solar System Right For You? Let’s Find Out

How Much Power Does A 4.5 KW Solar System Produce?

How Long Does It Take To Install Solar Panels: 2023 Guide

Everything You Need To Know About The Highest Wattage Solar Panels