What’s the Deal with Solar Tax Incentives?

As Solar Ambassadors, we know a lot of people who have either made the switch to solar power or who are seriously considering it. From my parents who recently added a 200W foldable solar panel to their RV, to a friend in Michigan who incorporated solar roofing tiles into the construction of a new home (they now generate twice as much energy as they use from April to September), to another friend building an off-grid cabin in the mountains of Montana, we have seen and helped with many different kinds of systems. As with any projects, cost is an important factor. If you are considering taking the solar plunge and want to save money through Federal and State tax incentives currently available, now may be your best bet.

With all the talk about government incentives, lately, it’s a little overwhelming to keep track of what’s going on. What ever happened to the Federal Solar Tax Incentives that rolled out a few years back? Hasn’t the current administration cut off those renewable energy incentives?

While it’s true that the current federal incentive program for any solar system installed on your home, RV, boat, or cabin, will end after December, 31, 2021, there’s still time to save a lot of money on your tax return between now and then. In addition to your federal return, many states also have tax incentives or programs to help you reduce the overall cost of your solar system, shortening the payback time on your investment.

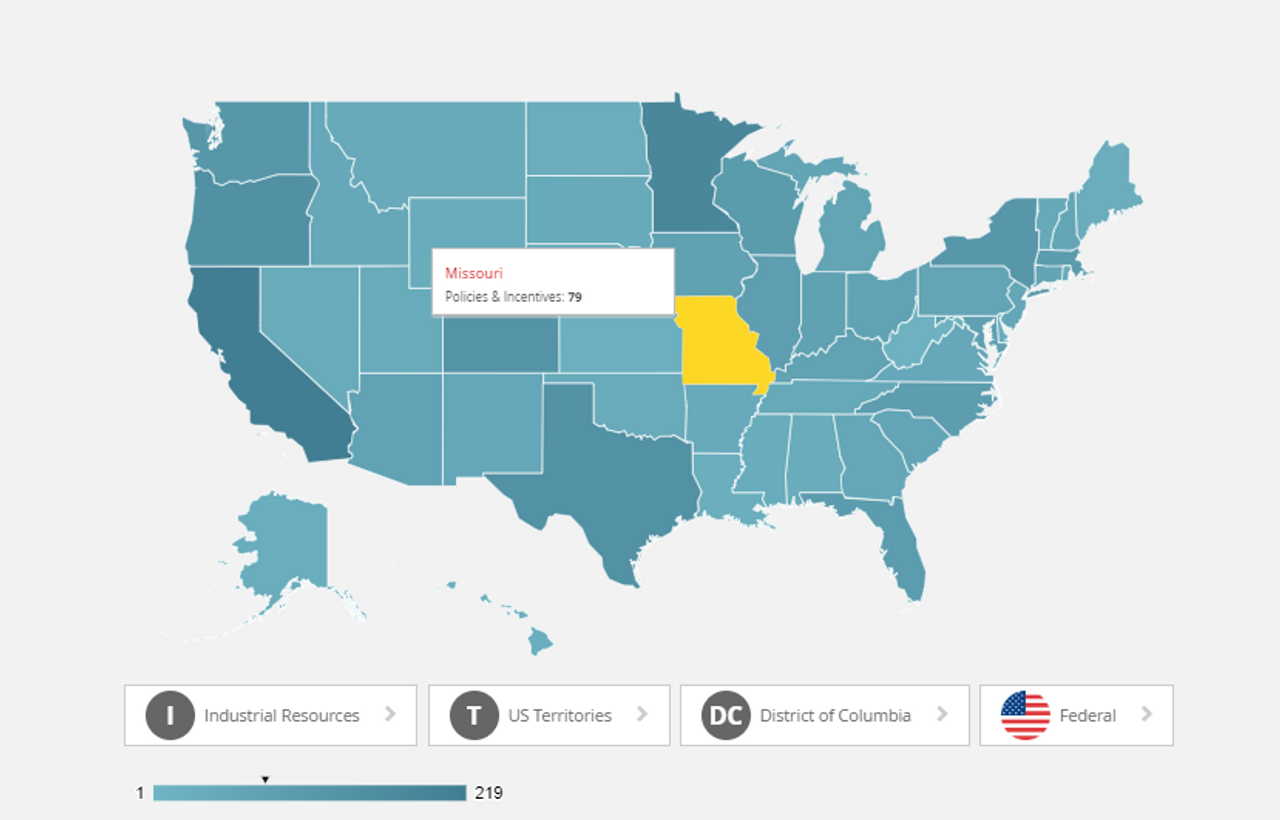

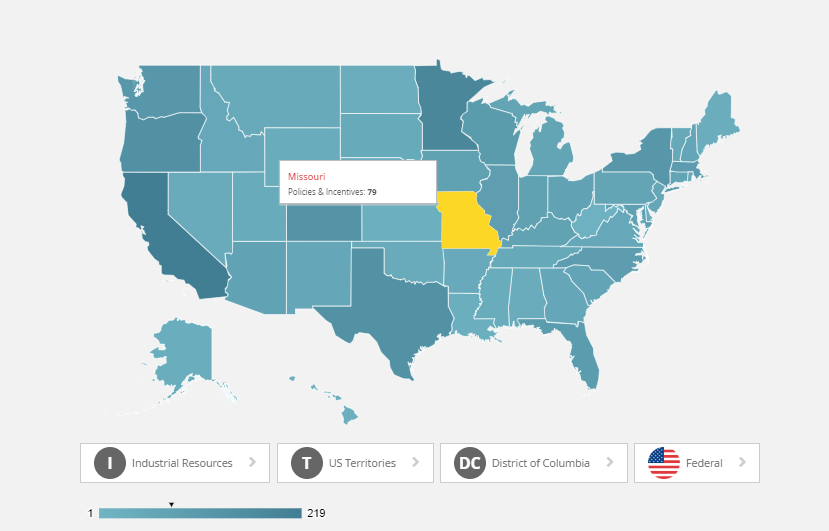

The federal incentive is pretty straight forward; a percentage of the overall cost of your installation can be claimed on your tax return. State incentives are a little more varied and complex, for example Massachusetts offers a solar loan reduction plan based upon income, while North Carolina allows any solar investment on your home to be excluded from the property tax value. To learn about your state’s programs, visit the Database of State Incentives for Renewables & Efficiency. And if you need help navigating the complexity of your state’s programs,finding a local installer might help cut through the confusion.

How Much Can I Claim?

The percentage of your installation that you can claim began at a whopping 30% in 2019, but is reduced to 26% for 2020, and then 22% for 2021. So, it makes both cents and sense to act soon! For a $12,000 system installed this year, your tax credit will be $3,120, but will only be $2,640 in 2021. Another bonus for acting early comes in the form of your next two year’s federal return. If your solar credit ends up being more than the total tax owed on your 2020 return, you can carry the remainder over to the 2021 tax year. It is unclear, at this point, if this benefit will be allowed to carry beyond 2021.

Does My RV Qualify?

As defined by the IRS, a home includes a “house, houseboat, mobile home, apartment cooperative, condominium, or manufactured home.” So, yes, the solar system you put on your RV, or off-grid cabin, qualifies for the program, whether you had a professional installer or if you did it yourself.

The credit not only applies to your primary residence, but also a vacation or secondary home. If you rent out your second home as a business, you won’t be able to claim the residential credit; instead you can apply for the commercial investment incentive program.

What Kind of System Qualifies?

Any complete solar system (of any size) installed and operational before January, 1, 2022, will qualify. Both on-grid or off-grid systems are included in the program, as well as any shared systems of which you might be a partial owner -- referred to as Community Solar.

What Costs Can I Include?

Usually, you can include all the costs, such as: materials, products, and labor for installing your solar system. This specifically includes panels that you install directly on the roof, or solar roofing tiles which perform double duty as energy producers and roofing surface. It does not, however, include any improvements that you might need to make to the roof of your house, support reinforcements, etc. which allows your roof to handle the weight of the panels. If you reinforce your roof, it’s still a roof and cannot be included in the tax credit. Anything specific to the panels, brackets, cables, inverters, and more can be included in the total investment cost.

What IRS Forms Do I Use?

To claim the credit for residential systems, you must file IRS Form 5695 to report your expenses. To claim the credit for commercial systems, you must file IRS Form 3468 to report your expenses.

What Records Do I Need to Keep?

All you need to retain for your records are any receipts for solar equipment and installation fees. You do not need to submit these receipts with your return, but save them with your tax information.

Can I Get Assistance with Financing?

With rates for home equity lines of credit dropping right now, check into your options with your bank. If you don’t own a home and need assistance with financing, Renogy can help!

If you are in a financial position to move forward on your solar project, and have found some time on your hands as a result of the COVID-19 pandemic, the resources below are a great place to begin.

Get Started with Solar!

As educators, it is our goal to try and make complex ideas simple and accessible so that people can get their head around them. We believe knowledge is power…and in this case, it’s sun power. We also love to answer questions, so feel free to contact us through our website.

FAQ’s: Over the past 7.5 years of living with mobile solar, we’ve gotten a ton of questions about our solar powered system. This comprehensive blog provides a whole lotta answers, and some additional resources.

How Solar Works: If physics or math scares you, don’t worry…solar is easy and very accessible once you get your head around a few key ideas. Leave the technical stuff to the engineers and installers, but it’s a good idea to know the lingo before you dive into purchasing a system. Here’s an additional video that will walk you through the basics of a small system.

Calculate Your Potential: Every location will have differing solar potential based upon latitude, open access to sky, and predominate climate. Learn what your location has to offer, it might surprise you.

Calculate Your Total Watt Hours: This is the magic number that engineers need to help you decide how large your system needs to be, including: how many and what size panels, how many batteries (for off-grid), and what type and size of both charge controller and inverter. Learn how to complete your own calculations.

Off-Grid vs. On-Grid: What’s the difference and how does it affect the equipment that you’ll need? These two blogs for Off and On-grid go further into details.

Further Reading for the Solar Inspired:

Common Challenges to Going Solar

How Much Solar Do I Need for my RV?

Ready to go solar? Get 10% off Renogy products by using this link and our discount code (canlife). We always love hearing from our readers and help work out solutions, so contact us with any questions or comments.

Shari Galiardi & David Hutchison have turned their higher education backgrounds, desire for life-long learning, and thirst for adventure travel into writing, photography, video production, and public speaking tours from coast to coast. Known to their friends as simply Shari & Hutch, you can learn more about their full-time, solar powered adventures on their website at freedominacan.com. Or, follow them on Facebook, Instagram, and YouTube as “Freedom in a Can.”